Click to get the details of the rating score

Nomad Fulcrum

Futureproof your wealth

Nomad Fulcrum is tokenized hedge fund that bridges the gap between tangible and digital worlds, it redefines the traditional mechanisms of investment,making assets more accessible, divisible, and liquid. Our business model reflects the essence of tokenization, contrasting with traditional asset fractionalization. Through Nomad Fulcrum, we set market trends.

Value Proposition

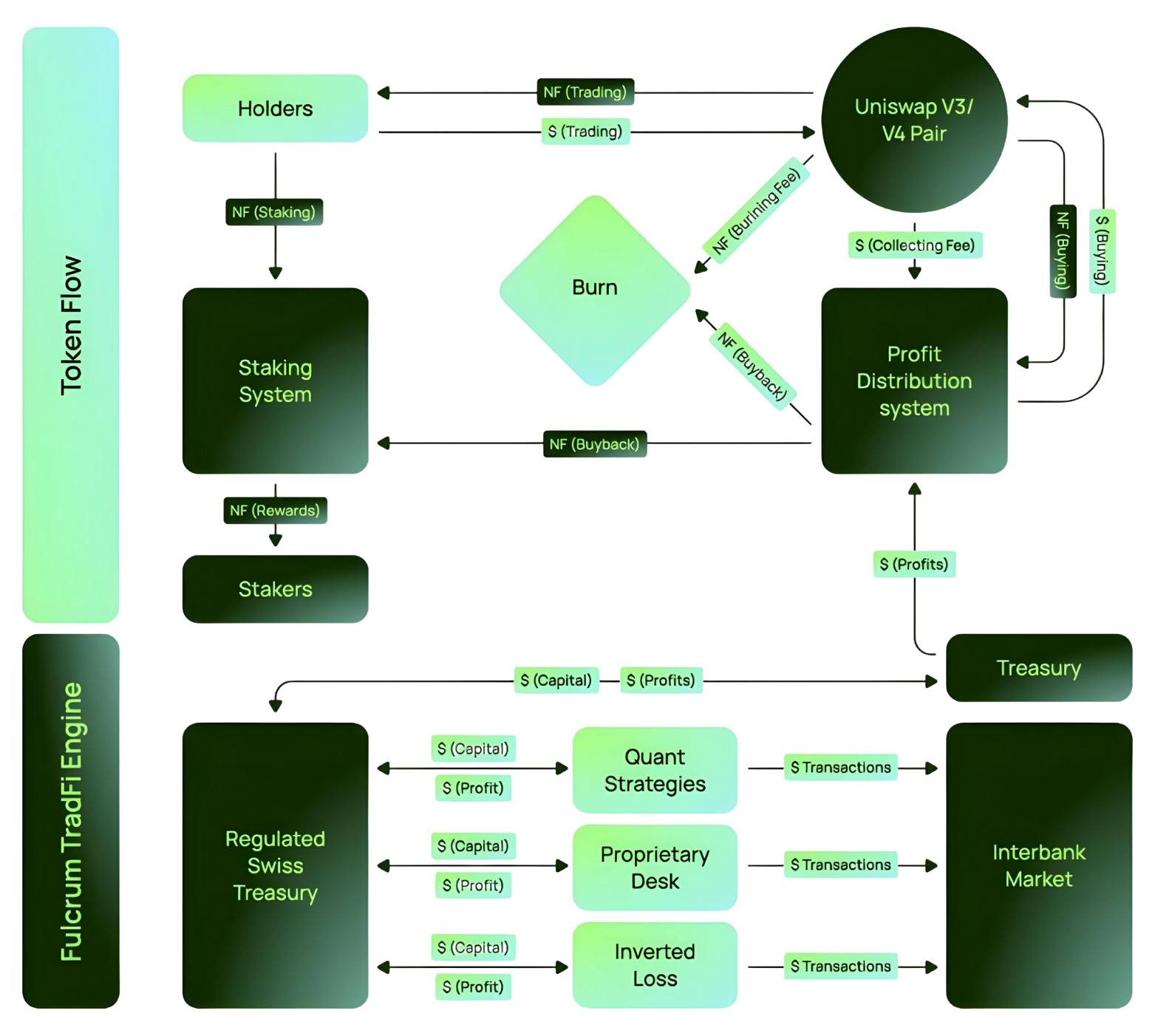

Dual-Source Liquidity and Profit Token

Nomad Fulcrum is distinguished by its dual-source liquidity model, a unique feature in the industry. It is the only company to harness liquidity from both the less liquid cryptocurrency market and the more fluid traditional financial market, enabled by a specialized license. The company’s main offering is an asset management-based token with a revenue-sharing attribute. Ownership of this token entitles the holder to a share of the profits, thus aligning liquidity provision with financial rewards. Clients purchasing the token are essentially buying a stake in future profits, which the company distributes as real earnings.

Technological Foundation

Advanced AI Investment Strategies

Nomad Fulcrum excels in creating decision-making algorithms using mathematical and quantitative modeling. Artificial Intelligence optimizes operations, reduces costs, and provides data-driven insights for enhanced decision-making, consistently generating alpha across all market conditions. It stands out in three areas: employing sophisticated AI and ML models to analyze extensive data and improve portfolio performance; utilizing delta-neutral strategies to minimize directional risk while capitalizing on market volatility; and implementing smart beta algorithms that systematically construct portfolios to either enhance returns or reduce risks compared to traditional indices.

Target Market

Targeted Growth and Strategic Partnerships

Nomad Fulcrum targets affluent and crypto investors, including managed accounts like family offices. Initial growth will leverage internal funds and business partnerships, progressing to a broader market. Future expansion will involve collaborations with centralized exchanges, banks, and liquidity providers. Early support will come from key opinion leaders to widen market reach, with subsequent efforts focused on user engagement. The company also plans to maintain stable yields regardless of market conditions through strategic partnerships with Equifi Bank and 1inch, enhancing product accessibility and reach.

Revenue Model

Three-Tiered Revenue Model

Nomad Fulcrum generates revenue through three primary channels: Management Fees, calculated as a percentage of assets under management to cover daily operational costs; Performance Fees, based on a percentage of the fund’s profits adjusted for a hurdle rate and high-water mark, ensuring payment only when the fund is profitable; and Transaction Fees, which significantly influence the fund’s overall operational revenues.

RWA Market Size by 2030

2023 Market Growth

Share of Global GDP by 2030

Compound Annual Growth Rate

Team

Momentum and Vision

Paweł Łaskarzewski, CEO

Paweł Łaskarzewski is a seasoned engineer and entrepreneur with 20+ years in aerospace, fintech, AI, and biotech. As COO and CTO at Galperin, he managed operations and tech initiatives. At Aion Bank, he oversaw corporate banking, IT, and compliance.

Damian Chojnowski, CFO

Damian Chojnowski, with a Finance and Accounting degree from the University of Warsaw, has deep expertise in credit risk and financial analysis. At Galperin Solution, he developed mobile banking solutions and managed tax structures. He led restructuring at the Bank Guarantee Fund.

For other Team Members see page 30 in the White Paper here

Data room

Documentation and Project Links

Website

White Paper

X (Twitter)

Current status of the project

Regulatory Compliance and Expansion Underway

As of the second quarter of 2024, Nomad Fulcrum is actively engaged in several key activities:

- Fundraising initiatives are currently in progress to support further growth and expansion.

- The implementation of KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures is underway, enhancing the firm’s regulatory compliance.

- The due diligence process for obtaining the FinMa (Swiss Financial Market Supervisory Authority) licensing is ongoing, which is a critical step in the firm’s expansion and regulatory alignment.

These efforts are part of the Nomad Fulcrum’s strategic plan to strengthen its operational framework and ensure adherence to global financial regulations.

BUSINESS PARTNERS

Why Nomad Fulcrum? Why Now?

Tokenization Market Set for Explosive Growth

The tokenization market is anticipated to achieve remarkable expansion, with projections estimating its value at $68 trillion by 2030, representing 10% of the global GDP. This represents a thirty-fold increase from 2023, with an annual growth rate of 18.9%, underscoring the sector’s rapid development and significant influence on the global financial landscape. As various regions globally adapt to this evolution, the integration of tokenized assets is poised to revolutionize investment approaches and economic frameworks at an unparalleled scale.

Fulcrum stands out by offering a competitive edge through enhanced transparency, allowing investors to directly verify transactions, positions, and strategies in real time, thereby cultivating greater trust and accountability than traditional hedge funds offer. In the realm of crypto markets, Real-World Assets (RWAs) involve assessing risk exposure linked to tokenized physical assets such as real estate, commodities, or art on blockchain platforms. These assets undergo risk evaluations that consider factors like asset type, market stability, and liquidity. RWAs rank as the 10th largest sector in decentralized finance (DeFi), according to data from DeFi Llama.

The tokenization of RWAs not only boosts efficiency and transparency but also minimizes human errors, as these assets can be securely stored and managed on blockchain networks. The growing interest in real-world assets is partly fueled by DeFi protocols that create yield by channeling user assets, typically stablecoins, into traditional investments such as government and corporate bonds.

Investment Terms

🌐 Blockchain Network

– Base / Arbitrum

🔢 Token Supply

$107,100,000

💵 Project Valuation

$14,994,000

📈 Initial Market Cap

$569,772

🤝 Platform Raise

Discussions ongoing

🎯 Hard Cap

$3,609,270

Disclaimer

Please read carefully before proceeding.

- No Investment Advice: The information on this platform does not constitute professional financial or investment advice. It is provided for informational purposes only. You should always seek independent advice from a qualified investment advisor before making any investment decisions.

- Risk of Loss: Investments carry inherent risks, and you could lose some or all of your invested capital. Past performance of any investment does not guarantee future results.

- Your Responsibility: You are solely responsible for your investment decisions, research, and outcomes. We shall not be liable for any losses incurred from your use of this platform.

- Third-Party Platform: By proceeding, you acknowledge that you will be redirected to Poolo, an external platform with its own set of terms, conditions, and risks. We are not affiliated with Poolo and are not responsible for their services.